Dubai clearly attracts UK entrepreneurs. It provides a strategic global hub, a pro-business tax environment, and world-class infrastructure. Opening bank accounts in Dubai is often complex for UK citizens or British companies, especially for a corporate one. Strict compliance and due diligence requirements govern this process.

Navigating the regulatory landscape of the UAE banking sector requires precision and expert guidance.

UK citizens can use this guide to establish a strong corporate bank presence in the Emirates. It clarifies the exact process, mandatory documents, and all strategic steps. A trusted consultancy can ensure a smooth, efficient application. We achieve this by helping you understand commercial keywords and high-intent checkpoints.

Why is a UAE Corporate Bank Account Crucial for UK Businesses?

If a UK company has business in the Middle East, a local corporate bank account is essential. Beyond the basic necessity of managing daily cash flow, it offers significant business advantages:

- Simplified Local and International Transactions: A UAE account facilitates seamless transactions with local partners and reduces foreign exchange costs for AED-denominated business.

- Enhanced Credibility and Trust: A local bank account establishes a legitimate presence, building immediate trust with UAE-based suppliers, clients, and government entities.

- Access to Trade Finance and Credit: Local banks offer essential services for growth. These include trade finance, letters of credit, and business loans.

- Compliance with Local Regulations: A corporate account ensures your business adheres to UAE financial regulations. It also separates business finances from personal funds.

Step-by-Step Guide for UK Citizens Opening a Corporate Bank Account

The UAE banking sector operates under rigorous Know-Your-Customer (KYC) and Anti-Money Laundering (AML) standards. While the process is methodical, UK citizens must prepare for stringent documentation and compliance checks.

Step 1: Establish Your UAE Business Entity

Before approaching any bank, your company must have a valid legal structure in the UAE. The banking requirements vary significantly based on your chosen jurisdiction:

- Free Zone Company: Often the preferred route for UK entrepreneurs focusing on international trade or advisory services. Free Zone companies benefit from 100% foreign ownership and easier return of capital. Banks are familiar with these entities, but due diligence is thorough.

- Mainland Company (LLC/Civil Company): This requires a Trade License from the Department of Economic. This requires a Trade License from the Department of Economic. Requires a Trade License from the Department of Economic Development (DED).

- Offshore Company: Primarily for holding assets and conducting business outside the UAE. Banking requirements are typically the most rigorous because their non-resident nature.

Step 2: Prepare Mandatory Documentation

This is the most critical stage. Banks in Dubai require an exhaustive set of documents to ensure the company's real, ownership structure, and business intent. For a UK citizen, the following is typically required:

Step 3: Selecting the Right Banking Partner

Choosing the correct bank is a strategic commercial decision. UK citizens should evaluate banks based on their specific business needs, such as:

- Minimum Balance Requirements: Many UAE banks set high minimum average monthly balances (from AED 50,000 to AED 500,000). A substantial penalties for failing to maintain this amount. This is a crucial financial keyword for budgeting.

- Account Types and Services: Look for services such as multi-currency accounts (GBP, USD, EUR, etc.). Also check for trade finance facilities and reliable digital banking platforms.

- Industry Preference: Some banks are more welcoming to specific industries (e.g., FinTech, E-commerce, or Trading).

- Compliance and Non-Resident Comfort: Look for banks with international branches or a strong presence in the UK. They are often more familiar with handling non-resident British business owners.

Step 4: Application Submission and Due Diligence

After preparing all documents, the authorised signatory must generally meet the bank's relationship manager in Dubai. This in-person meeting is mandatory. While some digital banks offer remote processes, traditional banks typically insist on a physical meeting.

The bank's compliance team will then conduct a thorough KYC/AML review, which includes:

- Verifying the source of funds and source of wealth for the shareholders.

- Investigating the commercial rationale and expected transaction patterns of the business.

- Cross-checking the background of all signatories against international watchlists.

The timeline for this due diligence phase is typically 2 to 6 weeks. It varies based on your company's complexity and the bank's workload.

The Flyingcolour® Advantage for UK Entrepreneurs

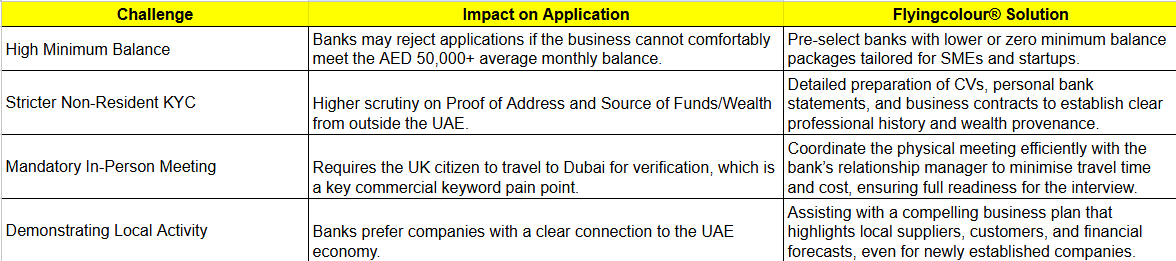

Navigating the stringent compliance landscape as a UK citizen can be a significant hurdle. This is where professional assistance becomes invaluable.

We specialises in streamlining the complex process of corporate opening bank accounts. Our expertise bridges the gap between the UK's corporate practices and the UAE's specific banking requirements.

Our service includes:

- Pre-Vetting and Bank Selection: We match your business (industry and turnover) with the right bank to boost your approval chances.

- Document Attestation and Preparation: We correctly format, translate, and attest all corporate and personal documents (including UK documents). This ensures they meet the bank’s exact specifications and prevents delays.

- Compliance Liaison: We link you to the bank's compliance department. We proactively address their queries and provide the necessary context about your business activity.

- Time-Use Keyword Inclusion: We combine PRO services for visa and company setup with our banking help. This creates a seamless, end-to-end solution.

Leveraging Flyingcolour®’s strong banking knowledge helps UK entrepreneurs bypass common pitfalls. They save time and significantly speed up account approval.

Conclusion: Your Corporate Financial Gateway Awaits

When a UK citizen manages to secure opening bank accounts for their company, it's a major milestone. This step transforms their promising venture into a fully active reality within a dynamic financial hub. The process is strict and needs careful preparation. However, the reward is access to a tax-efficient, globally connected banking system.

Do not allow the complexity of documentation and compliance checks to delay your business launch. Partnering with experts is a strategic decision, not just a convenience. It secures your corporate bank account efficiently and correctly right from the start.

FAQs:

1. Is a UAE Residence Visa mandatory for UK citizens to open a corporate bank account in Dubai?

A UAE residence visa and Emirates ID for the signatory simplify the process and expand banking options. But they are not always strictly mandatory for the company itself. Free Zone and Offshore companies allow non-resident shareholders/directors.

A UAE residence visa and Emirates ID for the signatory simplify the process and expand banking options. But they are not always strictly mandatory for the company itself.

2. How long does the corporate bank account opening process typically take for a UK-owned company?

A UAE residence visa and Emirates ID for the signatory simplify the process and expand banking options. But they are not always strictly mandatory for the company itself. Most of this time goes toward the bank's internal compliance, KYC, and due diligence checks on the UK shareholders and the business.

3. What is the average minimum balance required for a corporate bank account in Dubai?

Corporate accounts in Dubai usually require a minimum average monthly balance ranging from AED 25,000 to AED 500,000. The exact amount depends on the bank and your account package. Failure to maintain this average balance often results in a significant monthly maintenance fee. This is a critical factor for all UK entrepreneurs to budget for.

4. Can a UK citizen open a corporate bank account in Dubai remotely without visiting the UAE?

Generally, No. Generally, no. The authorised signatory (often a UK citizen) must be physically present in Dubai. This is for an initial in-person meeting to complete mandatory KYC checks and sign the necessary documents.

5. What is the single biggest reason for a corporate bank account application being rejected for UK citizens?

The biggest reason for rejection is failing to show clear evidence of your source of funds and what your business does. Banks are highly risk-averse. They reject applications lacking clear financial background, expected transactions, or complete/consistent documentation. A well-prepared business plan and full transparency are paramount.