Thinking of launching your business in the dynamic global hub of Dubai? If so, your first major decision will be choosing the right Free Zone—a task that can feel overwhelming with close to 30 options available in the emirate.

At DMCC (Dubai Multi Commodities Centre), the most common question we receive from UK investors is: “How different are the Cost of free zone company in Dubai across the various zones?” Understanding the financial landscape is, naturally, key to determining where you'll establish your Middle East base.

In this guide, we'll give you a clear look at the total expected expenditure for UK entrepreneurs looking at Dubai free zone company setup cost from UK, breaking down the key fees incurred before and after your company is officially set up.

Free zone company formation price for UK in Dubai

When you calculate your initial investment, you need to budget for four primary expense categories.

1. Company Registration Fee

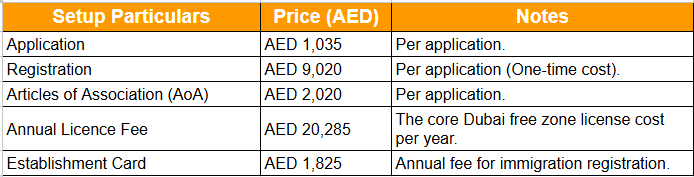

This is a one-time payment made to the Free Zone authority at the start of your registration process. The precise fee depends on your company's chosen legal structure and the specific Free Zone. For a premium jurisdiction like DMCC, the starting registration Cost of free zone company in Dubai is AED 9,000.

2. Licence Fee

Obtaining your business licence is a critical step for operating in a Dubai Free Zone. The three most common licence types are for trading, services, and industrial sectors. Unlike the registration fee, the licence fee is a recurring annual cost. This crucial part of your Dubai free zone license cost can range from approximately AED 10,000 to AED 50,000 per year.

3. Office Fee

Renting an office space or facility is a prerequisite for receiving your business licence in Dubai. To keep your initial Dubai free zone company setup cost from UK manageable, each free zone offers flexible solutions like serviced offices, smart desks, and Flexi-desks, which typically cost in the region of AED 15,000 to AED 20,000 annually.

DMCC offers world-class office solutions in the vibrant Jumeirah Lakes Towers (JLT) community, including flexi- and serviced desks, co-working spaces, and business centres. We also offer premium options in landmark buildings like Almas Tower, Jewellery and Gemplex, and the upcoming Uptown Tower.

4. Share Capital Requirement

The minimum mandatory share capital varies significantly among Free Zones, from as low as AED 1,000 to as much as AED 1,000,000, depending on your chosen business activities. Generally speaking, the average share capital requirement for Free Zones in Dubai is set at AED 50,000.

DMCC Business Set-Up Costs: An Investment in Prestige

While the Cost of free zone company in Dubai at DMCC may be higher than some of the regions advertising the Cheapest free zone company setup in UAE, this reflects the immense value, world-class infrastructure, and comprehensive business support we provide. Our seamless setup process means your company can be fully return in just 2-4 weeks, with much of the process handled remotely.

Here is a summary of the primary costs and available packages at DMCC:

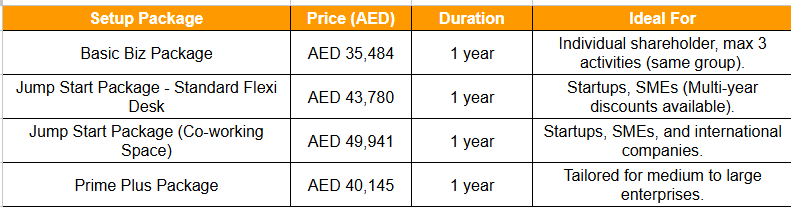

Company Setup Packages Pricing (DMCC)

Standard DMCC Setup Fees Breakdown

Specialised Industry and Freelance Pricing

DMCC offers dedicated ecosystem packages for niche high-growth sectors:

- DMCC Crypto Centre Package: AED 32,851

- DMCC Gaming Centre Package: AED 30,951

- DMCC AI Centre Package: AED 34,082

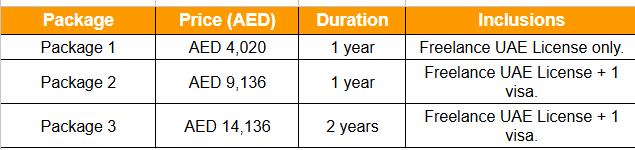

For UK professionals looking for the ultimate flexibility, our Freelance Packages offer a much lower Free zone company formation price for UK in Dubai:

Why Choose DMCC Over the Cheapest Free Zone Company Setup in UAE?

While other jurisdictions may advertise a lower price point, DMCC's position as one of the world's leading Free Zones is built on more than just low entry costs. We offer UK entrepreneurs a vast range of business opportunities—over 900 distinct activities across 20 sectors.

In Flyingcolour®, As a major contributor to Dubai’s economy and a global hub for trade and commerce, DMCC is a thriving, business district, home to over 25,000 companies. Choosing DMCC is an investment in unparalleled prestige, infrastructure, and a vibrant community of over 100,000 professionals, ensuring your business is perfectly positioned for global growth.

FAQ:

1. Is it easy for a UK national to set up a business in Dubai?

Yes, the process is now relatively straightforward. With the support of experienced consultants and the streamlined procedures of Free Zones like DMCC, establishing your presence in Dubai is highly efficient.

2. How long does it take to fully set up a business in DMCC?

Typically, it takes between 2-4 weeks for your business to be fully operational in DMCC. Several steps, including initial application and registration, can be completed remotely.

3. What is the average Dubai free zone license cost in DMCC?

The core annual Dubai free zone license cost at DMCC starts around AED 20,285, with total package prices (including registration and a facility) starting at AED 35,484 for the Basic Biz Package.

4. Can I secure a visa for myself and my employees through DMCC?

Yes. DMCC offers comprehensive visa services for business owners and employees. The number of visas you are allocated depends directly on your chosen office solution (e.g., Flexi-desk vs. dedicated office space).

5. What is the most affordable route for an individual professional from the UK?

For individual professionals, the Cheapest free zone company setup in UAE in this jurisdiction is the DMCC Freelance Package, starting as low as AED 4,020 for a one-year licence (without visa).