UK entrepreneurs and investors rely on the UAE as a premier international business hub to expand their global footprint, protect assets, and benefit from favourable tax conditions. Specifically, establishing an offshore entity in the Emirates offers a powerful, streamlined solution for international operations. Understanding the process and the significant advantages is the first step toward unlocking this potential.

This guide provides a comprehensive overview of the advantages and critical considerations for those pursuing a UAE offshore company setup UK investors need to know about.

Why the UAE is a Strategic Choice for UK Investors

The UAE’s economic stability, strategic geographic location—bridging Europe, Asia, and Africa—and commitment to a pro-business environment make it very appealing to British investors. For entrepreneurs seeking maximum flexibility, privacy, and efficiency in managing global affairs, a Dubai offshore business from UK base offers distinct benefits compared to other offshore jurisdictions.

The offshore structure explicitly supports businesses that conduct activities outside the UAE. Complete ownership, privacy, and an attractive fiscal environment. Complete ownership, privacy, and an attractive fiscal environment are the three core reasons that motivate UAE/UK entrepreneurs to register an offshore company.

Unmatched Financial and Operational Advantages

The decision to pursue an offshore company registration UAE UK entrepreneurs can rely on is primarily driven by three core pillars: complete ownership, privacy, and an attractive fiscal environment.

- 100% Foreign Ownership: The UAE offshore model guarantees full ownership of the company to the foreign investor, removing the need for a local partner or sponsor. This ensures complete control over all business decisions and profits—a key requirement for British entrepreneurs.

- Tax Benefits for UAE Offshore UK Entrepreneurs: The single most attractive feature is the UAE’s highly beneficial tax regime, particularly when dealing with international income streams and wealth management.

- Zero Corporate Tax: Offshore companies generally benefit from a 0% corporate tax rate on their international income (provided they satisfy all local and international Economic Substance Regulations, if applicable).

- No Personal Income Tax: The UAE levies no personal income tax on salaries or wages, allowing individuals to retain 100% of their earnings.

- No Capital Gains or Inheritance Tax: Unlike the UK, the UAE does not impose capital gains tax on the disposal of assets (shares, real estate, etc.) or inheritance tax, making it an ideal jurisdiction for long-term wealth preservation and estate planning.

Privacy and Asset Protection: Offshore entities provide a high degree of privacy. The public register typically does not disclose director and shareholder details, offering protection and privacy for high-net-worth individuals and corporate structures. This structure is excellent for isolating international assets from operational risks.

No Currency Restrictions: The UAE allows you to freely transfer funds in and out, which supports smooth international transactions without governmental controls.

Navigating the Dual Tax Landscape: UAE vs. UK

A crucial consideration for any British investor undertaking a Dubai offshore business from UK base is the complex interplay between the UAE's favourable tax environment and their existing UK tax residency status. While the UAE offers significant local tax exemptions, setting up a company overseas does not automatically exempt you from UK tax obligations.

The Critical UK Tax Rules to Consider

UK tax law contains stringent anti-avoidance legislation designed to prevent UK residents from diverting profits to low-tax jurisdictions. For UK entrepreneurs, three areas demand particular attention:

- Controlled Foreign Company (CFC) Rules: The UK's CFC rules may attribute the profits of a foreign company (like a UAE offshore entity) to the UK shareholders if the company is controlled by UK residents and pays less than 75% of the UK corporation tax rate. Proper structuring and genuine commercial activity are essential to mitigate this risk.

- Central Management and Control (CMC): When the key strategic decisions and central management of the UAE offshore company originate in the UK, HMRC may deem the company UK-resident for tax purposes, subjecting its worldwide profits to UK Corporation Tax. The physical location of board meetings and the company's operational presence must align with its official jurisdiction.

- Transfer of Assets Abroad (TOAA) Rules: These rules prevent UK residents from transferring assets to an offshore entity to avoid personal income tax. If authorities determine a tax-avoidance motive, the UK resident must include.ne a tax-avoidance motive, the UK resident must include the foreign company's income and pay tax accordingly.

For these reasons, securing expert, dual-jurisdictional advice is mandatory. A professional advisory firm like Flyingcolour® specialises in creating structures that are compliant with both UAE and UK regulations, ensuring your venture is legally sound and fully optimised.

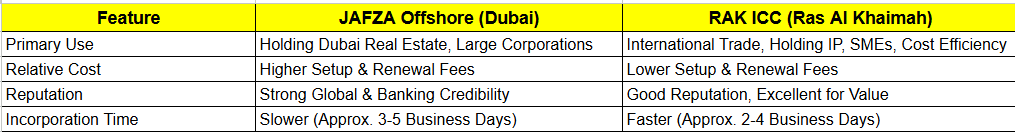

Offshore Jurisdictions in the UAE: JAFZA vs. RAK ICC

When finalising your UAE offshore company setup UK entrepreneurs must choose the specific registration authority. The two primary, most popular offshore jurisdictions are Jebel Ali Free Zone Authority (JAFZA) in Dubai and Ras Al Khaimah International Corporate Centre (RAK ICC). The best choice depends entirely on your specific business goals.

Jebel Ali Free Zone Authority (JAFZA Offshore)

- Key Advantage: Real Estate: JAFZA is the older, more established offshore entity and is highly favoured for investors who wish to hold property in specific approved areas of Dubai. It is often a popular choice for structured real estate investment portfolios.

- Credibility: JAFZA carries strong global recognition, which can sometimes provide an advantage when opening corporate bank accounts with major international financial institutions.

- Cost & Timeline: Generally involves higher setup and annual renewal costs compared to RAK ICC, and the formation process may take slightly longer.

Ras Al Khaimah International Corporate Centre (RAK ICC)

- Key Advantage: Cost & Speed: RAK ICC provides a significantly more cost-effective solution and a quicker, more straightforward setup process, often completed in a matter of days.

- Flexibility: It is ideal for a broad range of activities, including international trading, intellectual property holding, and general holding companies.

- Fitness: It is often the preferred choice for startups, SMEs, and cost-conscious entrepreneurs who require a simple, efficient, and affordable offshore corporate structure. RAK ICC also offers structures like Foundations and Trusts for advanced wealth planning.

The Step-by-Step UAE Offshore Company Setup Process

While the setup process is streamlined, especially with expert guidance, it involves several key steps to ensure proper legal and regulatory compliance for your offshore company registration UAE UK venture.

Step 1: Strategic Planning and Jurisdiction Selection

Consult with experts, such as the team at Flyingcolour®, to define your core business activities (Holding, Consultancy, IP Management) and choose the appropriate jurisdiction (JAFZA or RAK ICC) based on your budget, asset-holding needs, and long-term goals.

Step 2: Document Preparation and Submission

Required documents for individual shareholders typically include:

- Attested Passport Copy

- Proof of UK Residency (Utility Bill or Bank Statement, less than 3 months old)

- Original Bank Reference Letter

- Detailed CV/Personal Information Sheet

- Details of the business activity and proposed company names

The chosen registered agent, such as us, will handle the drafting of the Memorandum and Articles of Association (MoA/AoA) and the board resolution.

Step 3: Name Reservation and Initial Approval

The agent submits the proposed company name for approval by the relevant offshore authority (JAFZA or RAK ICC).

Step 4: Final Submission, Fee Payment, and License Issuance

Upon final review and payment of all government and registration fees, the authority issues the Certificate of formation and a trade license (where applicable). This formally completes the UAE offshore company setup UK process.

Step 5: Corporate Bank Account Opening

The final, crucial step is opening a corporate bank account in the UAE. This can be challenging for offshore entities without local guidance. Your corporate service provider will facilitate this process, leveraging their relationships with local and international banks to ensure a smooth and timely account opening.

The Role of a Corporate Service Provider: Flyingcolour®

Navigating the nuances of international regulations, especially concerning the complex tax environment for a UAE offshore company setup UK investor, requires specialised expertise. A trusted partner is essential.

Flyingcolour® is a leading business advisory firm in the UAE, providing 360-degree support to UK entrepreneurs. Their services go beyond mere company registration to include:

- Dual-Jurisdiction Compliance: Providing vital advice on the UK’s CFC and CMC rules to ensure the offshore structure is robust against HMRC scrutiny.

- Tailored Structuring: Determining the ideal structure—be it an International Business Company (IBC), a Holding Company, or a Foundation—to meet specific asset protection and tax efficiency goals.

- End-to-End Processing: Handling all documentation, notarisation, liaising with government authorities, and managing the entire formation process.

- Bank Account Help: Significantly streamlining the often-difficult process of opening a corporate bank account in the UAE, a critical component for any Dubai offshore business from UK.

- Post-Setup Services: Offering ongoing compliance, accounting, and VAT support, ensuring the company remains in good standing locally and internationally.

By partnering with an experienced firm, UK entrepreneurs minimise delays, reduce the risk of non-compliance, and gain the peace of mind necessary to focus on their global commercial objectives.

Conclusion

The opportunity presented by a UAE offshore company setup UK investor is substantial: it offers a gateway to global markets, robust asset protection, and significant fiscal advantages. However, success hinges on a deep understanding of both UAE corporate law and the anti-avoidance legislation in the UK.

For any UK entrepreneur looking to leverage the stability, neutrality, and tax benefits of the Emirates, the structured route of an offshore company registration UAE UK entity provides a clear path forward. A firm offers the professional expertise to establish your international commercial structure efficiently, cost-effectively, and in full compliance with the laws of both nations. Take the next step toward global expansion and wealth security today.

FAQs:

1. What is the main difference between a UAE Offshore Company and a Free Zone Company for a UK resident?

A UAE Offshore Company is strictly for non-local activities, such as holding assets, managing IP, or conducting international trade outside the UAE. It cannot operate physically within the UAE, rent office space locally, or apply for residency visas.

A Free Zone Company, by contrast, is a physical entity that can operate and trade within the specific Free Zone, can rent physical or flexi-desk space, and is eligible to apply for UAE residency visas for its shareholders and employees. The choice depends entirely on whether you need a physical presence and visa fitness (Free Zone) or just a compliant, tax-efficient holding structure (Offshore).

2. Will setting up a UAE offshore company exempt me from paying UK tax?

No. Setting up a UAE offshore company setup UK investors must understand does not automatically exempt you from UK tax. If you remain a UK tax resident, your worldwide income (including income or dividends from your offshore company) may still be liable for UK taxation under rules like the Controlled Foreign Company (CFC) and Transfer of Assets Abroad (TOAA) rules.

To benefit legally, make sure your company’s central management and control operate outside the UK, and follow all UK tax disclosure rules strictly. Professional advice is essential to maintain full compliance.

3. Which offshore jurisdiction is better for holding Dubai real estate: JAFZA or RAK ICC?

JAFZA Offshore is historically the preferred and often most straightforward jurisdiction for holding real estate in designated areas of Dubai. While RAK ICC has also signed agreements allowing property ownership in Dubai, JAFZA’s established credibility in this specific sector makes it the leading choice for high-value real estate asset holding.

4. How long does the offshore company registration process typically take?

With a specialist consultant managing the process, the typical timeline for an offshore company registration UAE UK entity ranges from 3 to 7 working days for quick setups like RAK ICC, to around 2 to 4 weeks for more complex jurisdictions like JAFZA, largely depending on the speed of the relevant government authority's approvals and the collection of all necessary attested documents.

5. Can a UAE offshore company open a corporate bank account in Dubai?

Yes, a UAE offshore company can open a corporate bank account in Dubai. However, it is often more challenging than for a Free Zone or Mainland entity due to international compliance and anti-money laundering regulations.