All about profit margin scheme for VAT in UAE

Under the profit margin scheme taxable persons can calculate VAT on the profit margin earned on the eligible goods instead of the selling price of the goods. This scheme is introduced to avoid double taxation on second hand goods because at the time of first supply VAT has already levied. This scheme allows taxable person to pay VAT on profit earned on the supplies of eligible goods.

Let us understand through following example:

Profit Margin (Inclusive of VAT) = Selling price – purchasing price; AED 2,000 = 10,000 – 8,000

VAT =Profit Margin / 105 X 5; AED 95.24 = 2,000 / 105 X 5

Instead of; VAT = Selling price / 105 X 5; AED 476.19 = 10,000 / 105 X 5

But application of profit margin scheme is limited to supply of certain goods; following goods are eligible under the profit margin scheme:

1) Second-hand goods: tangible moveable property usable as it is or after repairs.

2) Antiques: goods which are 50 years old or more.

3) Collectors’ items such as stamps, coins, currency and other pieces of scientific, historical or archaeological interest.

Application of profit margin scheme is subject to following conditions,

• The goods should be purchased from:

• An unregistered person or

• A taxable person who has applied the profit margin scheme on the same goods previously

OR

• Input tax on the purchased goods should not be recovered as per VAT regulation.

It is clear from the above conditions that input tax should not be recovered on the goods supplied under the profit margin scheme. Further FTA had also clarified that profit margin scheme cannot be used for the goods on which VAT was not charged previously or bought before implementation of VAT in UAE Ie. before 01st Jan 2018.

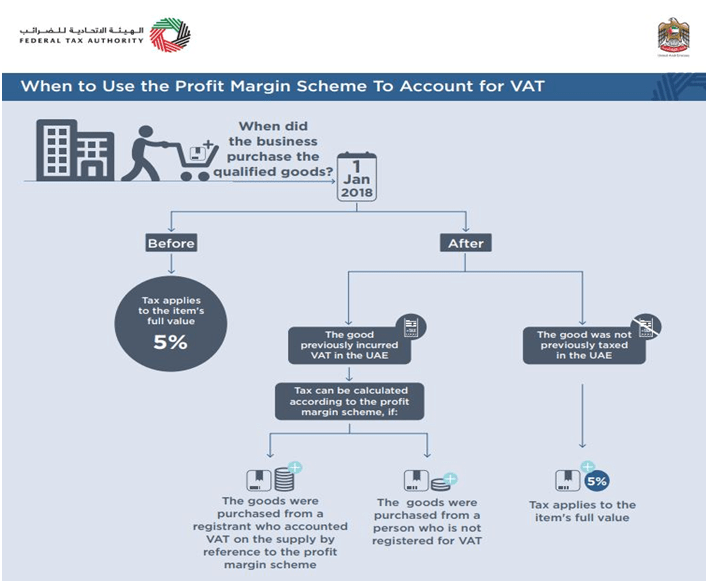

Following scenarios will help you to decide to decide whether to apply Profit Margin Scheme or not:

| Sr. No. | Scenario | Treatment |

| 1 | Goods was purchased before 01st Jan 2018 | VAT should be applied on full selling price; Profit Margin Scheme will not applicable as goods was not subject to Vat before 01st Jan 2018. |

| 2 | Goods purchased on or after 01st Jan 2018 from unregistered supplier and the goods may have been purchased before 01st Jan 2018. | VAT should be applied on full selling price, Profit Margin Scheme will not applicable unless evidence is available to show the goods had been subject to VAT on an earlier supply. |

| 3 | Goods purchased on or after 01st Jan 2018 from a supplier who purchased the goods after 01st Jan 2018 | The goods are eligible to be sold under profit margin scheme subject to evidence showing that goods VAT charged on earlier supply. |

Recently FTA has published following flyer for quick reference to Profit Margin Scheme:

Flying Colour Tax Consultants competent team could assist you in:

- Timely and Correct Submission of VAT Tax Return (Form VAT201).

- Timely and Correct Submission of VAT Tax Refunds (Form VAT311).

- Assistance in preparation of FTA compliant Books of Accounts.

- Assistance in FTA compliant Record Keeping & Documentation.

This blog post is written by Mr. Dilip. Feel free to call our Tax Advisor today for a quality consultation relating your VAT related queries. Please send inquiry to taxadvisor@flyingcolour.com or call +971 4 4542366.